how to calculate my paycheck in michigan

Now you can easily create a Form W-4 that reflects your planned tax withholding amount. For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Carolina residents only.

. Non-Probate Michigan Inheritances. Our network attorneys have an average customer rating of 48 out of 5 stars. It is not a substitute for the advice of an accountant or other tax professional.

Calc Current Interest Rate. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. If you failed to pay or underpaid your estimated income tax for 2011 you must fill out and file Form MI-2210 to calculate and pay any interest or penalties.

Figure out your filing status. Our network attorneys have an average customer rating of 48 out of 5 stars. Is Your Loan Upside Down.

Figure out your filing status. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Other Situations in Michigan Inheritance Law.

Instead you fill out Steps 2 3 and 4. Subtract any deductions and payroll taxes from the gross pay to get net pay. Being subjected to Michigan inheritance laws include life insurance policies with a beneficiary retirement accounts jointly owned property property in a living trust and payable-upon-death bank accounts.

The Michigan income tax has one tax bracket with a maximum marginal income tax of 425 as of 2022. Get the right guidance with an attorney by your side. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

Switch to hourly calculator. Free Federal and State Paycheck Withholding Calculator. Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. This number is the gross pay per pay period. Calculating your Oregon state income tax is similar to the steps we listed on our Federal paycheck calculator.

Get the right guidance with an attorney by your side. 2021 2022 Paycheck and W-4 Check Calculator. Retirement Days to Retire.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any.

Calculating your Florida state income tax is similar to the steps we listed on our Federal paycheck calculator. Assets that are exempt from going through probate ie. Detailed Michigan state income tax rates and brackets are available on this page.

7 06 04 Adjusting Posted Dtl4 Records For New Members

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How We Paid Off Our Mortgage In 5 Years Marriage Kids Money

Michigan Payroll Taxes A Simplified Guide

How Much Would You Receive From Disability Benefits Washington Post

Social Security Disability Benefits Pay Chart 2020

Michigan Payroll Taxes A Simplified Guide

How Much Should I Pay For Healthcare Healthcare Affordability Ratio

Michigan Payroll Taxes A Simplified Guide

State W 4 Form Detailed Withholding Forms By State Chart

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Social Security Disability Benefits Pay Chart 2022

7 06 04 Adjusting Posted Dtl4 Records For New Members

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

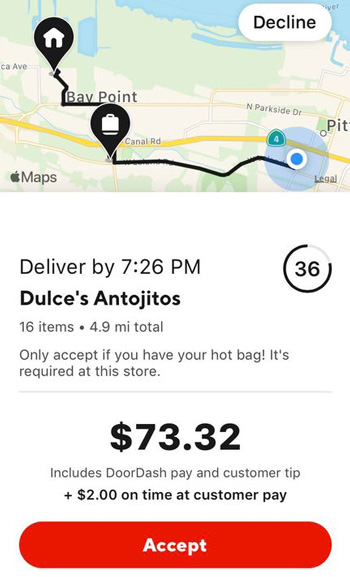

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver